Between the start and the finish was a day in which the Dow Jones industrial average swung 1,000 points and a wild final hour in which the market moved from almost 400 points down to 300 points higher, only to close down 128 points or 1.4 percent.

Between the start and the finish was a day in which the Dow Jones industrial average swung 1,000 points and a wild final hour in which the market moved from almost 400 points down to 300 points higher, only to close down 128 points or 1.4 percent.

Showing posts with label Dow Jones. Show all posts

Showing posts with label Dow Jones. Show all posts

Friday, October 10, 2008

Stocks Lower After Day of Wild Swings

Between the start and the finish was a day in which the Dow Jones industrial average swung 1,000 points and a wild final hour in which the market moved from almost 400 points down to 300 points higher, only to close down 128 points or 1.4 percent.

Between the start and the finish was a day in which the Dow Jones industrial average swung 1,000 points and a wild final hour in which the market moved from almost 400 points down to 300 points higher, only to close down 128 points or 1.4 percent.

Labels:

Dow Jones,

Dow Jones Industrial Index,

Wall Street

US stocks swing sharply in early trading

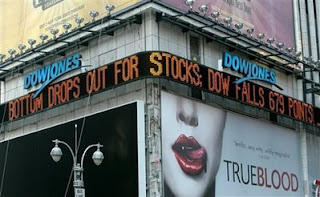

A news ticker display the latest stock market news in Time Square, New York, Thursday Oct. 9, 2008. Stocks plunged in the final minutes of trading Thursday, sending the Dow Jones industrials down more than 675 points, or more than 7 percent, to their lowest level in five years after a major credit ratings agency said it was considering cutting its rating on General Motors Corp. (AP Photos/Bebeto Matthews)

A news ticker display the latest stock market news in Time Square, New York, Thursday Oct. 9, 2008. Stocks plunged in the final minutes of trading Thursday, sending the Dow Jones industrials down more than 675 points, or more than 7 percent, to their lowest level in five years after a major credit ratings agency said it was considering cutting its rating on General Motors Corp. (AP Photos/Bebeto Matthews)Stock prices swung sharply in early trading Friday as investors again dumped stocks but also scooped up shares that have been devastated by more than a week of intense and panicked selling. The Dow Jones industrials, down nearly 700 points in the opening minutes of trading, recovered to a loss of just over 125 and then headed lower again.

Labels:

Dow Jones,

Dow Jones Industrial Index,

Wall Street

Global Markets Dive in Relentless Selloff

For almost 10 minutes on Friday, Wall Street seemed in a free-fall. The Dow Jones industrial average fell almost 700 points or about 8 percent in that time. The broader Standard & Poor’s 500-stock index, declined almost 8 percent.

For almost 10 minutes on Friday, Wall Street seemed in a free-fall. The Dow Jones industrial average fell almost 700 points or about 8 percent in that time. The broader Standard & Poor’s 500-stock index, declined almost 8 percent.

Labels:

Dow Jones,

Dow Jones Industrial Index,

Wall Street

Thursday, October 9, 2008

Stocks Plunge Again; Dow Under 9,000

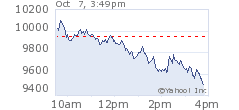

Tuesday, October 7, 2008

Dow falls 508 as panic takes over Wall Street

The Dow Jones industrials fell 508 points, or 5.1%, to 9,447. The Nasdaq Composite Index fell 108 points, or 5.8%, to 1,755, and the Standard & Poor's 500 Index was off 61 points, or 5.7%, to 996.

The Dow Jones industrials fell 508 points, or 5.1%, to 9,447. The Nasdaq Composite Index fell 108 points, or 5.8%, to 1,755, and the Standard & Poor's 500 Index was off 61 points, or 5.7%, to 996.

Labels:

Dow Jones,

Dow Jones Industrial Index,

US Economy,

Wall Street

Stocks tumble as Street worries about financials

Wall Street extended its steep declines Tuesday as enthusiasm over the Federal Reserve's latest efforts to inject frozen credit markets with a dose of much-needed confidence gave way to concerns about financial companies' balance sheets. Trading remained fractious, with the Dow Jones industrial average losing more than 225 points.

Wall Street extended its steep declines Tuesday as enthusiasm over the Federal Reserve's latest efforts to inject frozen credit markets with a dose of much-needed confidence gave way to concerns about financial companies' balance sheets. Trading remained fractious, with the Dow Jones industrial average losing more than 225 points.

Monday, October 6, 2008

Dow plunges 800 points amid global sell-off

Wall Street tumbled again Monday, joining a sell-off around the world as fears grew that the financial crisis will cascade through economies globally despite bailout efforts by the U.S. and other governments.

Wall Street tumbled again Monday, joining a sell-off around the world as fears grew that the financial crisis will cascade through economies globally despite bailout efforts by the U.S. and other governments.Wall Street suffered through another traumatic session Monday, with the Dow Jones industrials plunging as much as 800 points and setting a new record for a one-day point drop as investors despaired that the credit crisis would take a heavy toll around the world. The Dow also fell below 10,000 for the first time since 2004, and all the major indexes fell more than 7 percent.

Labels:

Dow Jones,

New York Stock Exchange,

US Economy,

Wall Street

Dow Jones Plummets - Again

Friday, October 3, 2008

Stocks drop on economic concerns despite bailout

Wall Street ended its worst week in seven years with another tumble on Friday on fears that the $700 billion financial rescue package may not unblock credit markets and stave off a U.S. recession. REUTERS/Graphics

Wall Street ended its worst week in seven years with another tumble on Friday on fears that the $700 billion financial rescue package may not unblock credit markets and stave off a U.S. recession. REUTERS/GraphicsFinancial stocks, which had traded sharply higher on the expectation the bill would be passed, fell after the House vote. Traders cited profit-taking and said the market was now focusing on the tough economic road still ahead and on how the bill will be implemented.

Tuesday, September 30, 2008

US stock plunge wipes record 1.2 trillion dollars off market value

Monday's record stock plunge saw approximately 1.2 trillion dollars wiped off the market value -- the first-ever trillion-dollar one-day loss, according to the Dow Jones Wilshire 5000, the broadest measure of market activity.

Labels:

Dow Jones,

New York Stock Exchange,

US Stock Market,

US Stocks

Monday, September 29, 2008

Monday, September 15, 2008

Dow falls 504 as Wall St. woes batter stocks

Stocks Slide as 2 Wall St. Banks Falter

Friday, June 20, 2008

Stocks plunge as oil rebounds

"The Dow Jones industrials were off 213 points, or 1.8%, to 11,872 at 2:25 p.m. ET. The Standard & Poor's 500 Index was off 25 points, or 1.8%, to 1,318, and the Nasdaq Composite Index dropped 58 points, or 2.4%, to 2404."

Wednesday, June 18, 2008

Dow tumbles on bank worries, oil spike

"Stocks are ending sharply lower amid renewed concerns about the financial sector and a rebound in oil prices."

Wednesday, June 11, 2008

Stocks decline as oil prices rebound

"Wall Street fell sharply Wednesday as oil prices rebounded, aggravating concerns that inflation may lead the world's central banks to raise interest rates. The Dow Jones industrial average fell more than 150 points."

Subscribe to:

Posts (Atom)